If you retained 5-500 w-2 employees since 2020 and were affected by Covid in any way you likely qualify to receive up to $26,000 per employee as tax credit refund even if you received a PPP loan in the past

As #1 ERC refund facilitator in the country and 14 years of Gov, grants and IRS experience Bottomline can help you get your max refund fast and without issue. You pay NOTHING until you have your cash in hand

What is the employee retention credit? (ERC)

ERC is an American Plan Rescue (CARES) Act stimulus program designed to help businesses affected by Covid from 2020/21 that were able to retain their employees during pandemic.

It is a refundable tax credit grant, not a loan and based on qualified wages and healthcare paid to employees. It has no restrictions or repayment and you may still qualify if you previously received PPP.

The ERC program is highly complex, underwent several changes and often beyond the scope of knowledge for the average CPA, accountant or tax professionals requiring advanced knowledge in both taxation and payroll, so many don’t fully understand the program or qualification requirements and may not be able to effectively assist their clients in obtaining these funds. If they havent already told you about this then thats a red flag, check with us first.

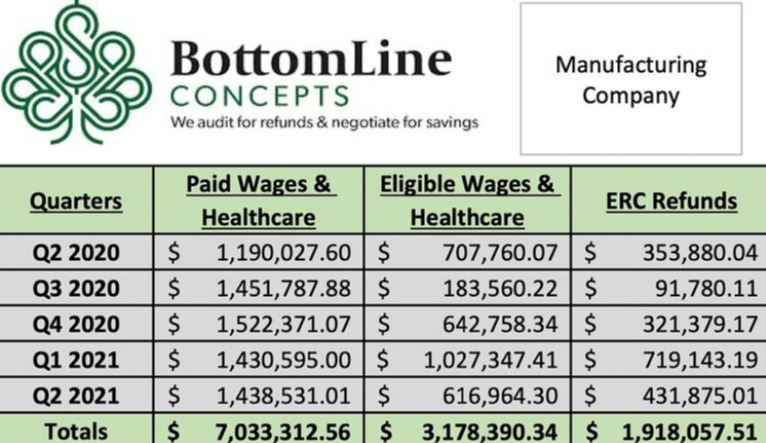

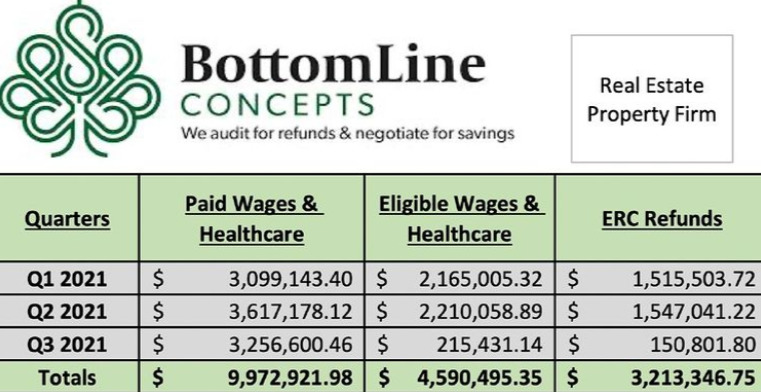

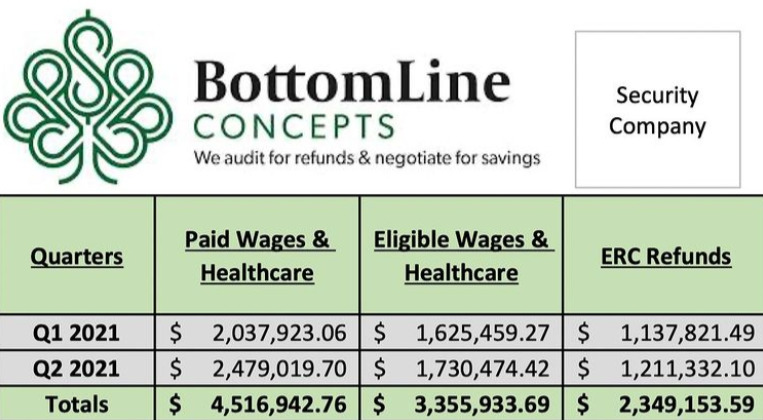

With decades of experience dealing with the IRS, Bottomline has successfully recovered $2.2 billion dollars in credits ($310 000 000 in just the last month) for 14,000+ clients, so our team understands how to efficiently create substantiating evidence to ensure the max credit is approved while staying safely within IRS guidelines and avoiding future problems and audits.

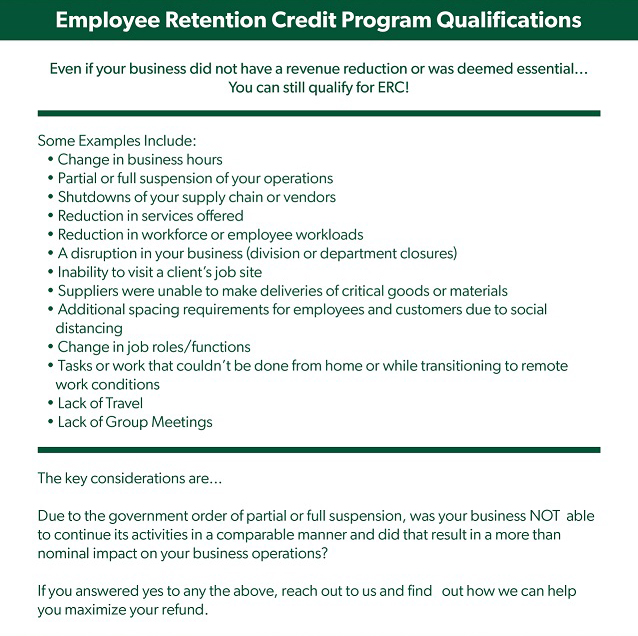

Qualification requirements

You can qualify through partial or complete suspension of operations OR reduced revenue OR supply chain interruptions where either resulted in you unable to achieve the revenue forecasted

Due to this most US businesses with 5< W2 employees since 2020 qualify! Dont miss your chance for a life changing refund, contact us for a 15 minute qualifying call, even if you’ve been told you dont qualify. No reduction in revenue required!

Basic qualification Requirements

- Partial or complete suspension of operations

- Revenue reduction during any quarter of 2020 or 2021

- Supply chain disruption during 2020 and 2021

What clients are saying

CEO, Healthcare Company

“The BLC team handled everything, from explaining the opportunity, to helping my team decipher what documents were needed, to calculating my refund! It could not have been a smoother and more efficient process!”

Refund: $1,954,236.23

VP Operations, Gym Owner

“I’ve had ERC on my list for the last 3 months but did not have the time to get it done. The BLC took care of everything. They were professional, explained all my options and helped me get this done. Now I can stop worrying about missing out on this once in a lifetime opportunity.”

Refund: $1,466,976.34

GM, Restaurant Client

“I didn’t even know ERC was a thing until BLC reached out. And I’m glad they did. Our team has a ton of pressure on them to keep our restaurant open and feed our community. Having this ERC refund was truly a lifesaver!!”

Refund: $856,111.56

No upfront cost

Bottomline is a zero upfront cost contingency-based cost savings company with 15y experience. You only pay a fee if you receive your refund

Why not do ERC yourself?

The ERC is highly complex, underwent several changes and often beyond the scope of knowledge for the average CPA or tax pro. We are #1 US experts

15 years Government expertise

With decades of experience dealing with the IRS, Bottomline has successfully recovered $2.2 billion dollars in credits for 13,000+ client

Zero Risk or Obligation

If no savings or refunds are identified and realized, you will not owe any fees whatsoever. If for whatever reason you choose not to move forward with our recommendations, that is acceptable.

Received PPP? You still qualify

Legislation changed, business owners are now eligible for the ERC even if they previously received PPP funds. $10,000 per employee is the average for companies that received PPP

What we do

We help make sense of it all. Our dedicated experts guide you on the steps you need to take so you can maximize the claim for your business. Fast and smooth end-to-end process from eligibility to claiming refunds

Request more info or zero cost no-obligation 15 minute qualification call

In 15 minutes discover if you qualify and an estimate for how much. You will never be asked to pay anything upfront. Fees are only requested once you get your refund in-hand.

If you dont get paid we dont get paid.

Frequently Asked Questions

ERC is an American Plan Rescue (CARES) Act stimulus program designed to help businesses affected by Covid from 2020/21 that were able to retain their employees during pandemic.

It is a refundable tax credit grant, not a loan and based on qualified wages and healthcare paid to employees. It has no restrictions or repayment and you may still qualify if you previously received PPP

Sound to good to be true? We get it. Take a look at these external references (or Google it) for more info:

IRS Website – U.S. Treasury Department – Journal of Accountancy – Investopedia.

When you’re done come chat to us, as the #1 “no upfront payment” ERC facilitator we get you your refund fast & pain/risk free.

This is an amazing but complex and time-limited opportunity for US businesses, thats not easily understood by your CPA or tax pro. We make sure you get the most benefit without the risk. Ask 14k other ecstatic clients why they chose Bottomline.

Firstly initial basic requirements are that you were in business prior to 2020, you had W2 employees since then and paid USA payroll tax.

Most importantly you can still qualify if you received PPP loan, you made a profit and didn’t show a revenue decline.

Many think they dont qualify due to no revenue impact however they can still qualify through partial suspension which most businesses experienced in some way, which is all you need.

In more detail: To qualify you require full or partial suspension of operations due to government order due to COVID-19 during any quarter or significant decline in gross receipts (beginning when gross receipts are less than 50% of gross receipts for the same calendar quarter in 2019 and ending in the first calendar quarter after the calendar quarter in which gross receipts are greater than 80 percent of gross receipts for the same calendar quarter in 2019).

Finally business owners who can show that the supply chain disruption caused by a government order rendered them unable to achieve the revenue they had forecasted.

Yes. Under the Consolidated Appropriations Act, businesses can now qualify for the ERC even if they already received a PPP loan. ERC will only apply to wages not used for the PPP.

Besides revenue decline you can almost certainly qualify through suspension / change in your operations.

Bottomline is a zero upfront payment leading contingency-based cost savings company helping businesses get grant money doing government recovery work for the last 15 years.

They have helped over 14,000+ businesses impacted by Covid-19 receive over $2.1 Billion in refunds from the ERC tax credit grant program so far.

Thye are the #1 expert on ERC, with decades of experience dealing with the IRS, and have facilitated the most refunds in the USA and are also trusted by 400 of the top fortune 1000 companies.

The ERC program is highly complex, underwent several changes and often beyond the scope of knowledge for the average CPA, accountant or tax professionals requiring advanced knowledge in both taxation and payroll, so many don’t fully understand the program or qualification requirements and may not be able to effectively assist their clients in obtaining these funds and sometimes most importantly do they have the time to work on this effectively even if they wanted to? If they haven’t already told you about this then that is a red flag, contact us.

If you choose to work with somebody lacking our 15 years of focused expertise and IRS experience, you run the risk of delays, claiming less or being unable to defend the credit later resulting in the IRS returning the credit with a 20% fine.

Why risk one of the best opportunities you might ever see in your lifetime? Dont leave this life changing opportunity in uncertain, distracted, overworked or uninterested hands.

No. This is a tax credit refund, not a loan. When we file your ERC claim you should receive a refund if your taxes are up to date.

You pay nothing upfront, Bottomline is a zero upfront payment leading contingency-based cost savings company. They only get paid when you do meaning they will work hard and fast to make sure you get your max refund asap. For dealing with this complex program there is fee payable on refund which differs for each client depending on many factors such as workload / complexity etc an can range from 10% to 30%.

Once filed, with speed depending o when you can provide the needed documentation, refunds are released based on IRS backlog. Currently, the IRS has stipulated a 20 week minimum turnaround on the ERC refunds.

No